Great news; as all YMCA Camps and Clubs are Ofsted registered and classified as childcare, you save money on the cost by paying with Childcare Vouchers (CCV) or the Government’s Tax-Free Childcare scheme (TFC).

Deciding to pay by CCV or TFC amounts to accepting to buy a service and will be subject to relevant booking conditions.

We can also accept payment by credit or debit card for any of our services. If you need any further information that isn’t covered below, call our team for advice: 01489 785228.

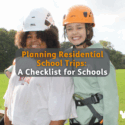

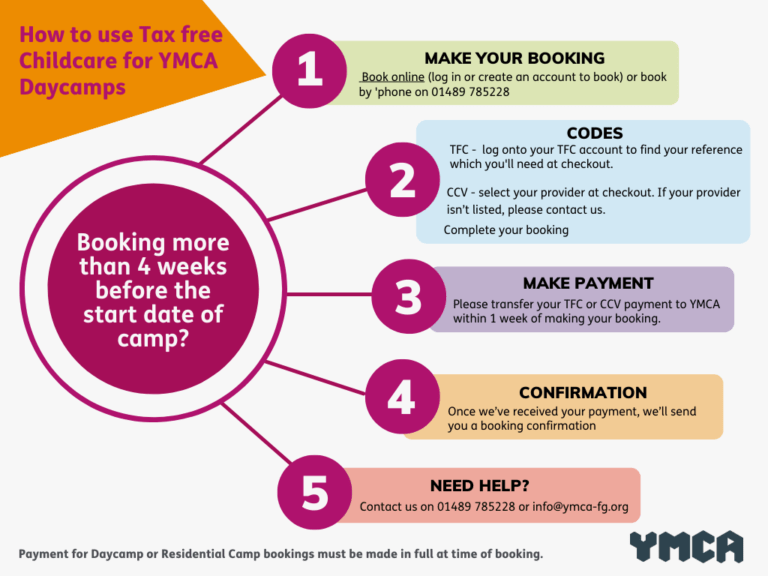

How to use Tax-Free Childcare and Childcare Voucher Payments for YMCA Daycamps

Payment for YMCA Camp or Club bookings must be made in full at the time of booking. To take advantage of any discounts, cleared payments must be received by the discount closing date for the discount to be applied. If payments are received after the discount deadline, the current rate at the payment receipt date will be applied.

Booking more than 4 weeks before the start date of the camp

If you choose to pay by CCV or TFC, payments can be sent directly to us via your CCV or TFC online portal. The reference must include your child’s name to match your YMCA Camp or Club booking.

You will need to log in or create a new account to make an online booking. At checkout, you will be asked for your TFC or CCV reference. Alternatively, bookings can be made with our sales team on 01489 785228.

Payment must be transferred within 1 week of making your booking. These voucher payments can only be used to pay for the childcare element of your booking. For example, if you are purchasing the Family Discount Scheme you will need to pay for this by credit or debit card.

- TFC – find the relevant YMCA service on the TFC system e.g. YMCA Fairthorne Group or YMCA Fairthorne Manor

- CCV – you may need the YMCA ID for your childcare provider. If your childcare voucher provider is not listed, please contact us

Booking within 4 weeks of the start date of the camp

Payment must be made in full at the time of booking. You are then able to send us your TFC or CCV payment for the childcare element of your booking which will be refunded back to you.

You will need to log in or create a new account to make an online booking. At checkout, you will be asked for your TFC or CCV reference. Alternatively, bookings can be made with our sales team on 01489 785228.

Then, transfer your TFC or CCV payment to us. This is only if you wish to pay by this method for the childcare element of your booking only.

- TFC – find the relevant YMCA service on the TFC system e.g. YMCA Fairthorne Group or YMCA Fairthorne Manor

- CCV – you may need the YMCA ID for your childcare provider. If your childcare voucher provider is not listed, please contact us.

Once we have received your TFC or CCV payment, the childcare element of your booking will be refunded back to the card with which you paid. Refunds can take up to 10 working days to process from receipt of your CCV/TFC payment.